NFTs change the future of digital media

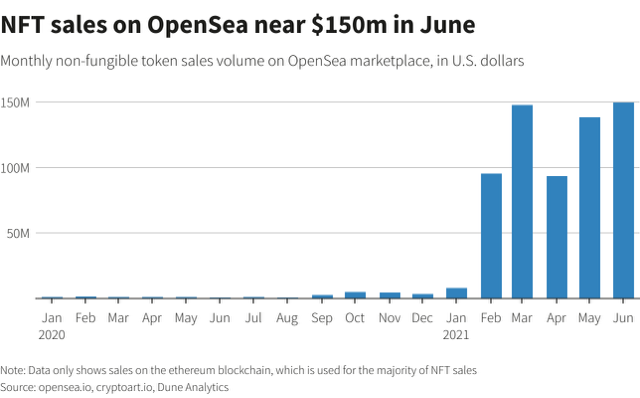

The sales volume of OpenSea, an NFT trading platform, rises to $150M in June of 2021 due to an increased interest in NFTs.

December 15, 2021

Innovative technologies are being unveiled at remarkable speeds. A major part of this wave is Non-fungible tokens, more commonly known as NFTs. NFTs are unique digital tokens that have the capability to be traded throughout a highly secure database called a blockchain. However, unlike cryptocurrencies, NFTs cannot be replaced or traded with a similar product or copy. This uniqueness gives them their value. Last March, NFTs took the world by storm with a $69.3 million purchase of a single digital art NFT. The purchase rapidly drew the attention of journalists, digital artists, investors, and video game companies alike, who were all eager to be a part of this growing industry.

“I think [in the future] you’re going to see them in areas you never thought they would be,” said LBHS AP Government, AP Macroeconomics, and economics teacher Mark Alvarez. “[For example], people invest a lot of time and a lot of effort and also money within the games that help them. And when they’re tired of the game, there is no resalable anything. You move on, and you’ve sunk hundreds of hours and maybe even dollars. [By] creating ecosystems of NFTs within games [in which] NFTs can be earned and be fully salable can make you appreciate why you play the game.”

An upsurge in the sales volume of NFTs(see chart) is mainly fueled by the “hype” or interest in these NFTs. Apart from the “flex” of owning an authentic NFT, the future of investing in NFTs remains bleak.

“I’d be very careful [about investing in NFTs] because it’s a new and speculative market. And with any investment, you only want to invest with a small percentage of your assets, and the lion share of your assets should be [invested] in things that you know to be true,” said Alvarez.

This new market has sparked debate following its establishment. There is a primary debate: whether or not NFTs have value or if the ownership of a non-fungible digital token is worth the money it’s bought for. Following the emergence of big purchases of NFTs, another debate that arose is whether or not the money being paid matches its actual value.

“What’s the value of anything but what someone’s willing to pay?” said Alvarez. “You have to wonder if that person were to bring that [NFT] to market a couple years later, would it recoup its principle, or would it depreciate a bit?”

The leading factors holding back the growth of these digital tokens is the lack of investors’ faith in the growth, security, and authenticity of NFTs. NFTs are highly reliant on the faith of the investors because the investors are what set the market value, and without their faith, the NFTs market value is volatile. However, unlike many cryptocurrencies, investors can have a small comfort in the security of NFTs to a degree. NFTs are stored on a modernized blockchain database. Blockchains record significant quantities of data and distribute it among thousands of blocks, making it harder for hackers to access. Harder, but not impossible, because once one blockchain block is changed, a hacker must change each block’s identification or “hash” within five minutes. Secure or not, this blockchain helps store data about the origin of the NFT and the data on the trading history, which increases the uniqueness of the NFTs, thus increasing their value. However, determining the authenticity of the NFT remains a major issue and causes hesitation among investors in NFTs.

“The world of cryptocurrencies and NFTs are like the Wild West,” said Alvarez. “The sheer number of cryptocurrencies clearly aren’t all needed to facilitate transactions, so it’s truly speculative. We still need to determine who are the players of the future.”